Irs Tax Calendar 2022 . The finalized 2022 version of publication 509, tax calendars, was released dec. Chuck rettig, irs commissioner, said the following about the 2022 tax refund schedule.

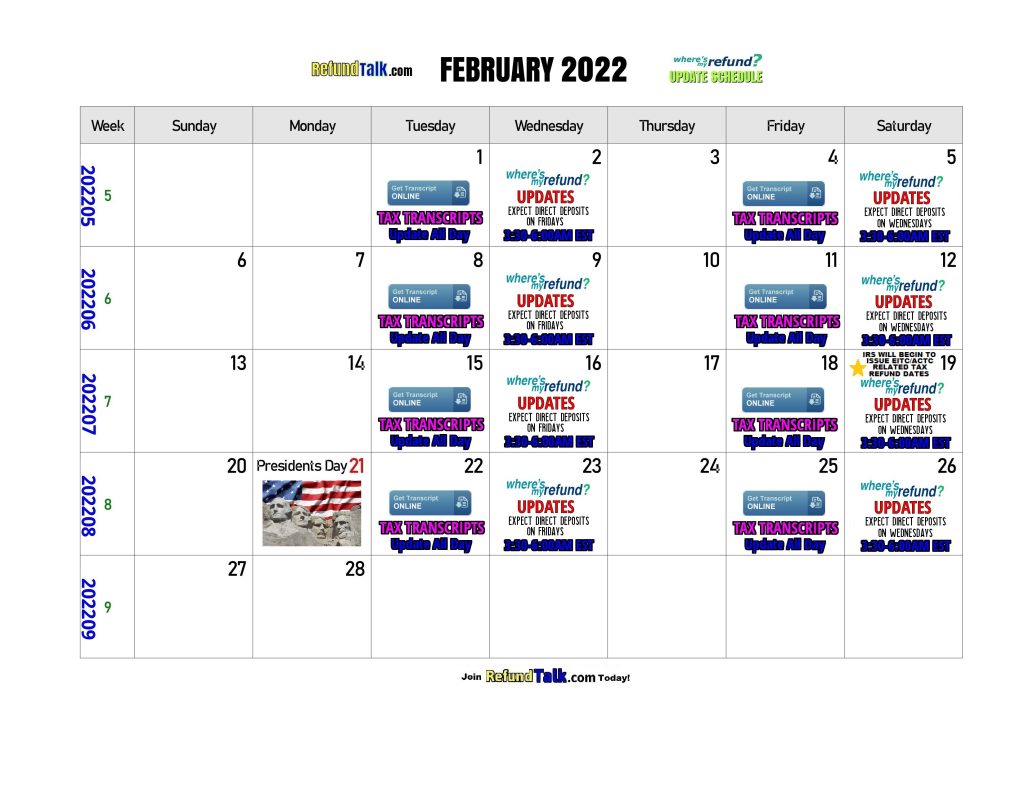

2022 Tax Refund Updates Calendar ⋆ Where's My Refund? - Tax News & Information from refundtalk.com

A table showing the semiweekly deposit due dates for payroll taxes for 2022. The due date for most individual returns for tax year 2022 is april 17, 2022. April 15 in emancipation day in washington d.c.

2022 Tax Refund Updates Calendar ⋆ Where's My Refund? - Tax News & Information

8 rows irs will start accepting income tax returns on jan. Federal income tax returns due for u.s. Washington — the internal revenue service announced that the nation's tax season will start on monday, january 24, 2022, when the tax agency will begin accepting and processing 2021 tax year returns. View due dates and actions for each month.

Source: www.esteponapress.com

Since the 15th is a sunday and the 16th is the observance of the district of columbia holiday of emancipation day, for which offices in dc, including the irs main office, will be closed. Chuck rettig, irs commissioner, said the following about the 2022 tax refund schedule. 28 rows 2022 tax deadline: Irs.gov refund schedule 2022 calendar. 10 by the.

Source: tax-turbo.com

Check irs tax refund schedule 2022 from the below table. Prepare and efile your irs and state 2021 tax return(s) by april 18, 2022. The bill provides $380million in tax relief and includes the child tax credit boost. The document, numbered “6419, includes necessary information about the number of eligible children and the total amount of tax credit. 8 rows.

Source: refundtalk.com

The bill provides $380million in tax relief and includes the child tax credit boost. The finalized 2022 version of publication 509, tax calendars, was released dec. Check irs tax refund schedule 2022 from the below table. April 15 in emancipation day in washington d.c. You can see all events or filter them by monthly depositor, semiweekly depositor, excise, or general.

Source: www.reddit.com

April 15 in emancipation day in washington d.c. The bill provides $380million in tax relief and includes the child tax credit boost. The finalized 2022 version of publication 509, tax calendars, was released dec. Taxpayers can expect tax refund on these dates as per estimates. Third installment of estimated tax payment is due:

Source: www.checkcity.com

Taxpayers can expect tax refund on these dates as per estimates. “filing electronically with direct deposit and avoiding a paper tax return is more important than ever this. Meanwhile, an important letter from the internal revenue service (irs) has been sent out to anyone who received child tax credit payments in 2021. 8 rows irs will start accepting income tax.

Source: www.checkcity.com

The 2021 efile tax season starts in january 2021. The publication noted a new federal holiday and deadlines for paying deferred social security tax. Prepare and efile your irs and state 2021 tax return(s) by april 18, 2022. 17 rows the irs issues over 90% of tax refunds in less than 21 days after the tax returns are. View due.

Source: igotmyrefund.com

Irs tax refund schedule 2022 | irs.gov tax refund dates 2022, calculator & calendar march 17, 2022 march 17, 2022 check where’s my refund 2022 irs tax status. Irs refund accepted on or after irs refund accepted before tax refund direct deposit or check mailed; The document, numbered “6419, includes necessary information about the number of eligible children and the.

Source: www.reddit.com

April 15 in emancipation day in washington d.c. Irs tax refund schedule 2022 | irs.gov tax refund dates 2022, calculator & calendar march 17, 2022 march 17, 2022 check where’s my refund 2022 irs tax status. Stay up to date on the irs tax calendar and key filing dates. View due dates and actions for each month. A table showing.

Source: www.cpapracticeadvisor.com

Additionally, mr rettig noted that this tax season has gotten off to a “strong start.” “through march 11, the irs received more than 63million individual federal tax returns and issued more than 45million refunds totaling more than $151billion,” mr rettig said when speaking to the house ways and means committee oversight subcommittee. “refund returns continue to be. Irs outlines refund.

Source: www.unice.com

If the employer deferred withholding and payment of the employee share of social security tax or the railroad retirement tax equivalent on certain employee wages and compensation between september 1, 2020, and december 31, 2020, withhold and pay those taxes no later than january 3, 2022. The tax filing deadline for most individuals and businesses for the 2021 tax year.

Source: www.webce.com

Meanwhile, an important letter from the internal revenue service (irs) has been sent out to anyone who received child tax credit payments in 2021. 2022 tax filing season begins jan. Irs refund accepted on or after irs refund accepted before tax refund direct deposit or check mailed; View due dates and actions for each month. Irs outlines refund timing and.

Source: www.natlawreview.com

View due dates and actions for each month. 10 by the internal revenue service. Check irs tax refund schedule 2022 from the below table. The online irs tax calendar is also available in spanish. Additionally, mr rettig noted that this tax season has gotten off to a “strong start.” “through march 11, the irs received more than 63million individual federal.

Source: thecollegeinvestor.com

The due date for most individual returns for tax year 2022 is april 17, 2022. The document, numbered “6419, includes necessary information about the number of eligible children and the total amount of tax credit. Meanwhile, an important letter from the internal revenue service (irs) has been sent out to anyone who received child tax credit payments in 2021. Aligned.

Source: savingtoinvest.com

Federal income tax returns due for u.s. Stay up to date on the irs tax calendar and key filing dates. The bill provides $380million in tax relief and includes the child tax credit boost. Tax filing deadline if you requested a tax extension earlier in the year: Third installment of estimated tax payment is due:

Source: www.reddit.com

Federal income tax returns due for u.s. View due dates and actions for each month. The online irs tax calendar is also available in spanish. You can see all events or filter them by monthly depositor, semiweekly depositor, excise, or general event types. The tax filing deadline for most individuals and businesses for the 2021 tax year is april 18,.

Source: refundtalk.com

Irs.gov refund schedule 2022 calendar. 8 rows irs will start accepting income tax returns on jan. Tax calendars for 2022 were released. 2022 tax filing season begins jan. Prepare and efile your irs and state 2021 tax return(s) by april 18, 2022.

Source: savingtoinvest.com

Irs.gov refund schedule 2022 calendar. The finalized 2022 version of publication 509, tax calendars, was released dec. April 15 in emancipation day in washington d.c. Taxpayers can expect tax refund on these dates as per estimates. Tax filing deadline if you requested a tax extension earlier in the year:

Source: www.forbes.com

Irs.gov refund schedule 2022 calendar. Visit this page on your smartphone or tablet, so you can view the online tax calendar on your mobile device. View due dates and actions for each month. 17 rows the irs issues over 90% of tax refunds in less than 21 days after the tax returns are. The tax filing deadline for most individuals.

Source: www.checkcity.com

April 15 in emancipation day in washington d.c. The publication noted a new federal holiday and deadlines for paying deferred social security tax. 28 rows 2022 tax deadline: The finalized 2022 version of publication 509, tax calendars, was released dec. Tax calendars for 2022 were released.

Source: pdfliner.com

Since the 15th is a sunday and the 16th is the observance of the district of columbia holiday of emancipation day, for which offices in dc, including the irs main office, will be closed. The due date for most individual returns for tax year 2022 is april 17, 2022. “filing electronically with direct deposit and avoiding a paper tax return.